Having a vacation home to rent out is one investment that most landlords dream of adding to their real estate portfolio, combining it with rental properties that are intended for long-term tenancy. Since vacation rentals are usually for short-term stays, it’s a good way for landlords to diversify their investments.

However, just like with other investments, there are advantages and disadvantages to renting out vacation homes. Before buying your first vacation rental property, make sure that you carefully weigh the pros and cons so that you will get the most from such investment.

The advantages and disadvantages are not only for financial aspects, but for personal matters as well. Here’s a basic list to help you decide:

THE PERKS

It’s a financial asset

As a smart investor, you want to make sure that, as much as possible, every property you own will bring in additional income, and that includes vacation homes that you rent out for short-term stays. As the term suggests, a vacation home is a place where you can vacate to if you want to temporarily move away from your daily routine of life and work. This means that if you do occupy your vacation home once in a while, it’s only wise to earn from it on days that it is unoccupied by renting it out to other vacationing individuals.

Most landlords earn an average of $900 per month from renting out their vacation homes – and that rate goes even higher by four or five times for vacation homes located in in-demand locations.

You can occupy it if you need to

Since it will only be used for a short vacation, tenants will be temporary and no tenant will be granted an entire year of exclusive use (unless a guest decides to go on vacation for an entire year, but that’s highly unlikely). The good thing about this is you can occupy it if you want to take a break from your busy life or you want to host a vacation with family and friends. This is why, when choosing a vacation home to buy, it’s best that you find one in a place that you also love to get away to for vacations.

On top of that, you can even consider it as the home you will retire to in the future.

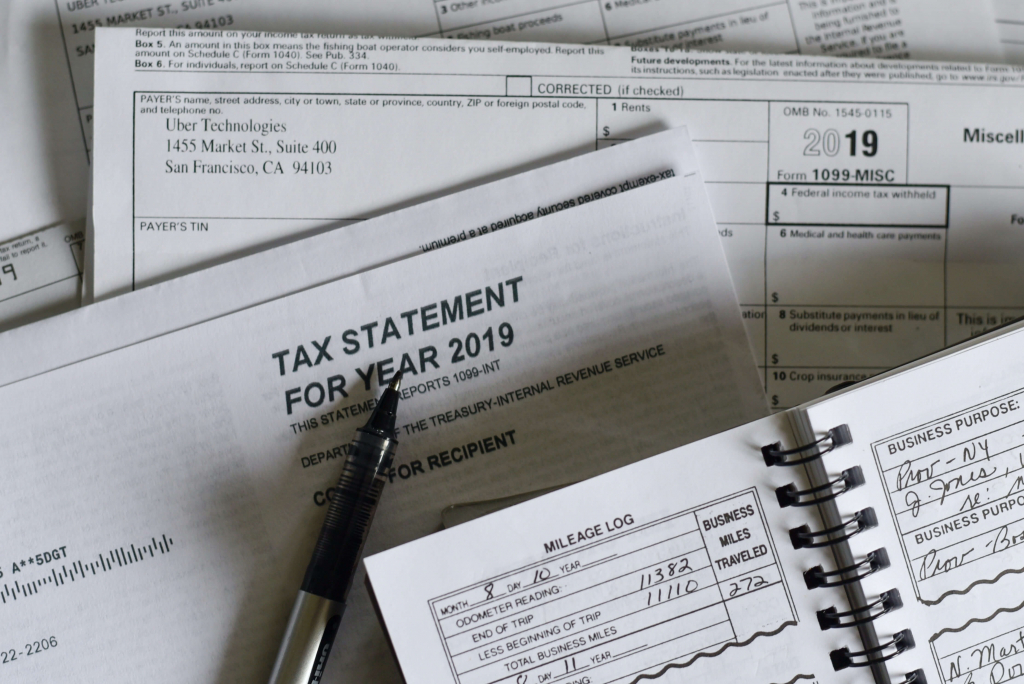

Tax advantage

If you rent the property for 14 days or more, it will be considered as operating a business, which can be taxable. Even though that doesn’t really sound appealing, but it also means that you can write off the expenses you will incur for maintaining the property.

You can write off expenses for cleaning, repairs, insurance, utility costs, mortgage interests, occupancy taxes, landscape maintenance, property management fees, basic household supplies, and even fees from online rental platforms that you will utilize.

This is even more advantageous if you have a diversified set of rental properties.

THE DOWNSIDE

More management is required

Unlike rental properties for long-term stays, a vacation home needs the landlord or property manager to be hands-on. After every stay, you have to inspect the property, clean and prepare it for the next guest, and restock supplies (tissue paper, soap, K-cups, etc.). That could become a lot of work especially if it attracts a lot of tourists.

You also have to make sure to address any wear and tear, which will be more likely to come up due to the volume of different people staying in it.

Constant marketing

You also need to market your property in order to decrease vacancy rate. You may even need to give promotional discounts in low seasons. However, this disadvantage is more manageable now since it’s easier to market online. You can post your listing on platforms likes Padleads then syndicate it to popular rental websites. The platform can be used even by your property manager or rental agent.

May be difficult to acquire

Vacation homes are not allowed everywhere so you have to check if your city allows short-term rental activity because some places ban it entirely or require special licenses.

Loans for financing vacation homes also often require higher interest rates. This may be a huge factor for a property investor.

THE BOTTOM LINE

A vacation home is a great way to diversify your property portfolio. If you believe that the advantages outweigh the disadvantages, and you can find a way to be able to manage the risks involved, then it may be a good investment to consider.