When you’ve just started on your venture to real estate, filling out tax forms can often be very stressful. If you have earned rental income from your property in the past year, then you would need to file a Schedule-E form along with your personal tax return (a.k.a. 1040). Here’s a quick guide on what this form is how to fill it up:

What is Schedule E?

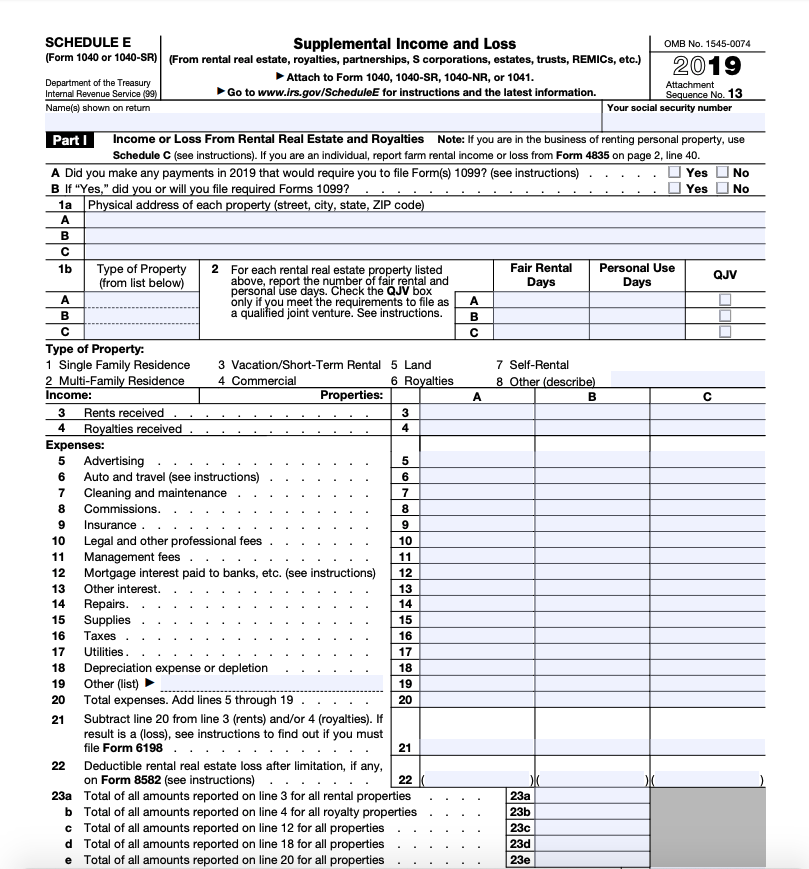

IRS Schedule E – Supplemental Income or Loss is used to collect information that report income and loss of real estate business activity as well as other passive income businesses.

First and foremost, you have to make sure that the Schedule-E form is the right one for you. If you are a real estate owner who operates many real estate rental properties as your business and you provide other services to your tenants, you will be required by the IRS to file a Schedule C rather than a Schedule E. This is why those who are just starting out with one rental property (with no other services offered) file a Schedule E; same goes with those who are simply renting out a room within their own home.

This is what a Schedule E form looks like:

ABC

The first lines labeled “A,” “B,” “C” is where you write down the address of your properties. So if you only have one property, then you only have to fill up line A, and the other details (type of property, fair rental days, income, expenses) of that property will all be written on the succeeding “A” rows and columns.

If you have two properties, then the details of the second property will be written on the “B” rows and columns.

EXPENSES

The expenses portion allows you to deduct the costs you incurred to operate the business such as advertising, insurance, management fees, utilities, etc.

• Repairs and Maintenance

You may able to deduct repairs and maintenance, but you can’t deduct costs for improvement.

Costs for pool cleaning, pest control, and gardening would fall under maintenance. Painting, plumbing repairs, and replacing broken windows would fall under repairs. But if you made improvements such as adding a complete HVAC system, that will be considered as an improvement and therefore cannot be added to the list.

• Depreciation

Most of the expenses listed are easy to understand. The most confusing section for most landlords is “Depreciation expense or depletion.” If you are unsure of the fair market property of the buildings and land that you possess, just divide the value between them according to their assessed values for the purpose of real estate tax.

Land is never depreciable, so make sure that the land value will not be included in the figure you’ll write down.

ALLOWABLE DEDUCTIONS

According to IRS, you are allowed to deduct up to $25,000 from your income every year. This is if you have active participation when it comes to managing your rental real estate properties.

If you record a loss more than that limit, you can carry over or “recapture” the excess amount for your next tax year. For example, you recorded a loss of $35,000 this year, which is $10,000 excess from the allowed $25,000. That excess can be carried over for next year’s tax.

The IRS website provides resources for the different tax forms. It is important that after learning the basics, you should familiarize yourself with other forms and tax fees that you may encounter as you grow in the business.

Since expenses are a vital part in determining your tax, it is important that you keep all receipts of your business transactions. But make sure that you don’t spend just to incur expenses; make sure that you’ll get value for your money. For instance, if you do your marketing through listing management websites like Padleads, you can surely reach a lot of interested tenants.