It’s not a secret that renting out that spare bedroom in your house can generate income. The extra money can help manage your expenses. If you have no problem with a stranger staying with you, then why not give it a try? But before you do that, you have to know what you are getting into.

Yes, that tiny extra space you have can be a money-maker but did you think about other expenses? You do have to spend money and not just collect them. You will be paying taxes too.

Yes, even renting a spare bedroom will require you to pay additional taxes because it generates income. But don’t fret, there are ways on how to lessen the tax you need to pay.

You need to pay taxes the same with other landlords renting out whole properties. The amount of tax that you need to pay can be lessened if you include the expenses related to the rental. The difference with other landlords is that you have to separately compute your expenses. The amount of money you spent on your rental should not be included in the amount you spent on your whole property and vice versa.

Deductible items:

After you decide to rent out that spare room, it will not be automatically habitable. There are required standards that you should follow before it will be considered a legal unit. That also means you have to spend money before you earn it. The good news is, you can deduct those from your taxes. Here are some examples:

Cost for advertising

Making your property listing at Padleads requires payment but don’t worry because it is worth it. The cost will include syndicating your listing to other well-known websites. If you are also planning to use other means of advertising besides online marketing, you have to set a separate budget for that as well.

Repairs made to the rental unit (flooring, doors, windows, etc.)

As I’ve mentioned above, there are certain standards to follow before your rental will be considered legal. Therefore, necessary repairs may have to be done to the unit.

Basic utilities like electricity and plumbing

For your rental to be considered legal, there should be electricity and access to a water supply. If there are none, it is expected that you would install these things.

Housekeeping services

It is important to maintain a clean environment not just for you but for your tenant. This will help avoid threats for everyone’s health that can be caused by a dirty area.

Insurance

You already have a homeowner’s insurance that you pay for. If you rent out a room, you will be advised to get a landlord’s insurance too.

Security

You do not necessarily have to hire someone as security for just one tenant but you do have to provide the locks to different entry points. You might also want to install security cameras on the property.

Trash and snow removal

Part of keeping a safe and clean environment for your tenant is to avail of pick up services for your trash and having the snow removed around your property.

Repairs made to the amenities used by the tenant

The tenant will not only use that spare room. They will also be allowed to use the other parts of the house for their daily needs. For example, they would need to use the kitchen to prepare their meals.

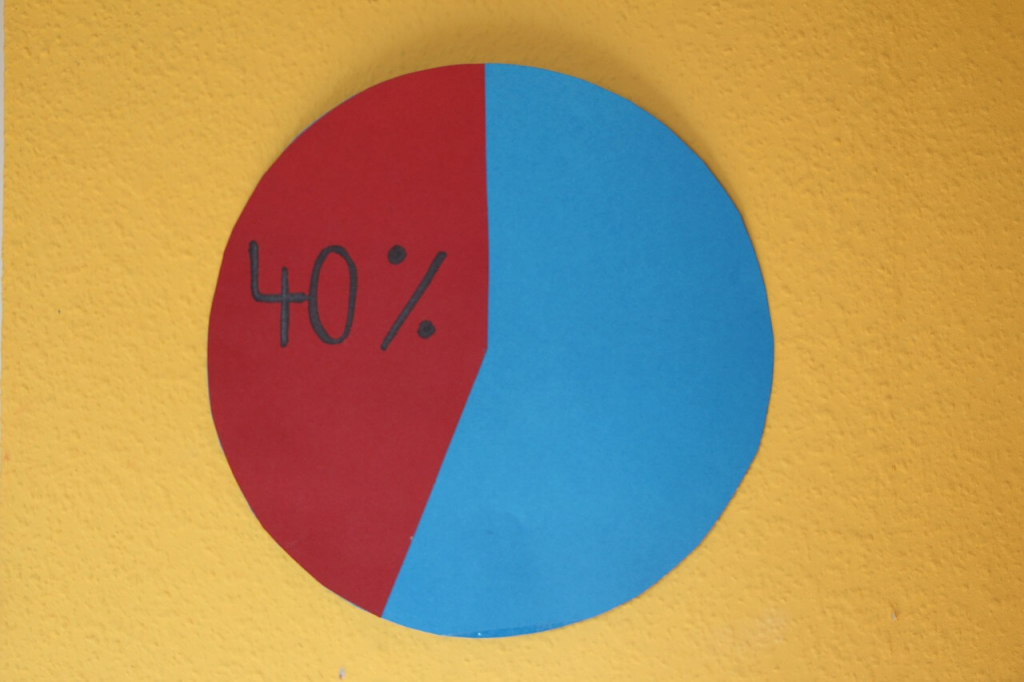

You also have two ways to compute for the division of expenses. The first one can be based on the number of rooms in your property. The other one is based on the area of your home. But between the two, you can get a larger deduction using the number of rooms.

Have you decided yet? Think it over and decide if this is for you. Not everyone can be a landlord but it will not hurt to try.